Two for Tuesday - Vol. 3

ONE

What did you fail at today? This is the question Sara Blakely (founder of Spanx, valued at over $1B) and her brother would be asked by their dad on a regular basis.

The implication was that if you didn’t fail at anything, you didn’t try something new or worthwhile. You didn’t push yourself. Failure represented growth.

Failure was being reframed as a great thing.

From Shane Parrish, in his Brain Food blog:

Kobe Bryant on having the courage to look like a fool:

“If I wanted to implement something new into my game, I’d see it and try incorporating it immediately. I wasn’t scared of missing, looking bad, or being embarrassed. That’s because I always kept the end result, the long game, in my mind.”

The ability to look past what others think of you is a superpower. Harness it. Fail often.

TWO

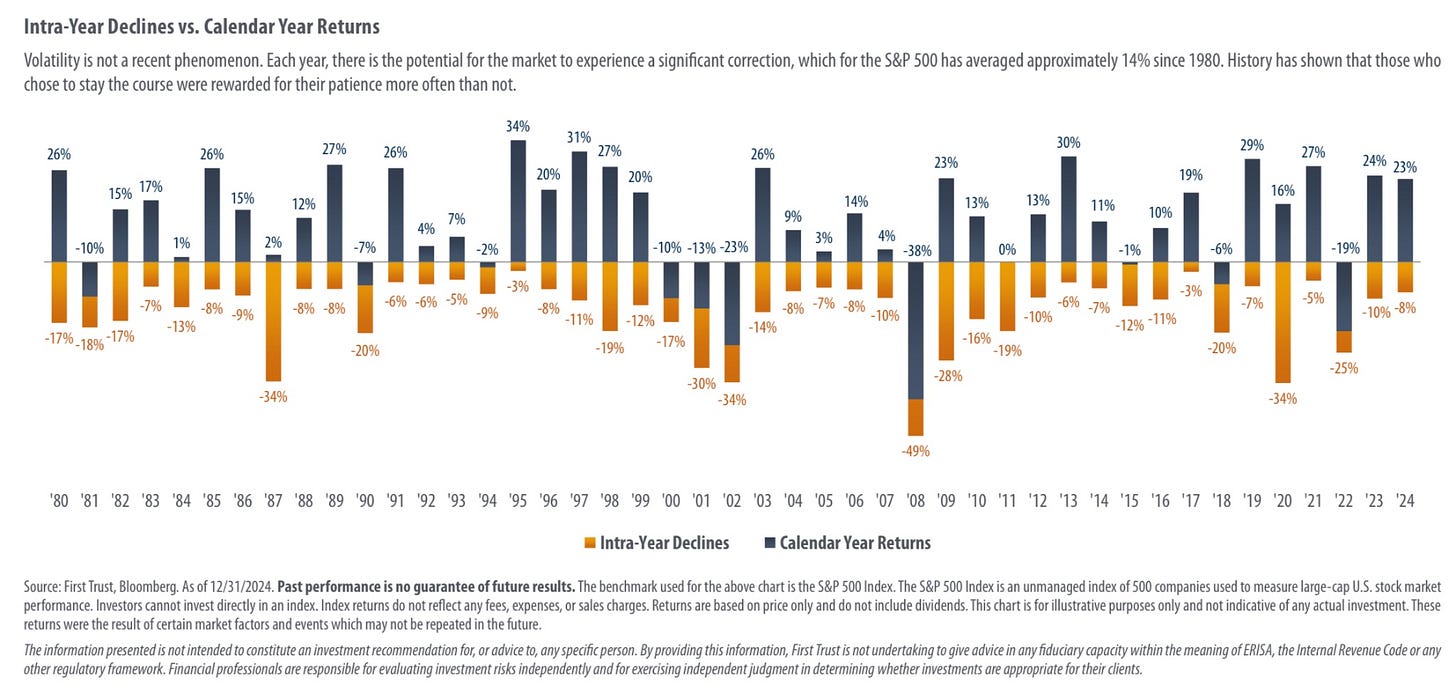

Markets go down regularly. It’s a feature of the markets, not a bug.

Since 1980, the average annual market move to the downside has been 14%. The chart below shows the largest intra-year decline each year (yellow/orange), along with the final calendar year return (dark blue).

To date, we are roughly 9% off the all-time S&P 500 high point, which was reached less than 30 days ago on Feb. 19. Might we fall further? Absolutely we might. Might we go up from here? Also possible.

“Volatility is the price of admission. The prize inside are superior long-term returns. You have to pay the price to get the returns. Many aren't.” – Morgan Housel

Be willing to pay the price for the prize, particularly with funds you don’t need in the near term.

Invest well.